What is Fast Close?

Rarely seen such a clear case. CFO’s have discovered the advantages of Fast Close some time ago and more and more controllers are discovering the methodology for Fast closing periods and fiscal years. You don’t have to explain a controller that a reporting cycle of 5 days instead of 15 days saves a lot of money. Shortening the reporting cycle quickly releases 65.000 euro from this process! I am surprised to see that more than 60% of all companies require more than 15 days to create the monthly reporting and close the period.

What is Fast close?

Fast close is the process to quickly execute the reporting cycle and distribute the relevant management information and financial statements. How quickly is fast and when are you amongst the best? You are amongst the best if you can present the monthly results in 5 working days, your quarterly results in 20 working days, your annual results in 30 working days and complete your budget cycle in 30 working days. In the US and UK and larger public companies Fast close is the standard.

Why have we not considered Fast close any earlier?

A controller is always under pressure. We therefor don’t take time for self-reflection. Am I doing the right things and doing the things right are questions to ask yourself? Daily issues disturb the closing process and are often used as an excuse why due dates cannot be met. I would like to present to you some examples that can hopefully be recognized. Many times we have heard these responses to the question why companies have not yet introduced Fast Close:

- We understand the advantage and usefulness of Fast close, but we are waiting until all companies are on the same ERP system. This should help us to come to a uniform closing.

- The people that should do the implementation are tied up in another project

- Fast Close is a project that takes 8 to 18 months.

- We have no time to implement Fast Close in our department, because we need 15 days per month for the reporting process.

- If we shorten the reporting cycle, we may become redundant.

If you have a closer look at these responses, you can see that there are no valid arguments to NOT implement Fast Close

The effect of these excuses is that, in case the reporting cycle takes longer than 5 days, your company has allocated an excess of money in this process and will not be able to release that sum for other important projects that should be implemented to support the organization.

Are these arguments valid?

Basically not or only partially. A risk analysis brings clarity here:

- We will wait until the last company is on the new ERP system. Risk is that it will be continuously postponed, caused by delay in the ERP implementation, a new acquisition etc. The costs will remain to be stuck in the reporting cycle.

- The same people are doing all the projects. If you dare to break the circle, you suddenly get a lot more people available for other activities like projects. Risk: these people go from project to project and before you know they are on another project and you lose the chance to implement Fast close in this setting.

- Fast Close is a project that takes 8 to 18 months. This number is based on the presentations of the external consultants…… Risk: you will take this number for real if you have no knowledge of the new methodologies. Fact is that in these difficult times you will not start an 8 – 18 months during project. This principle is outdated, you can now implement a Fast closing cycle for your entire organization in just a few days, regardless of the number of participations.

- We have no time, our reporting cycle takes 15 days or more. This is straight forward. Risk: you can never implement improvements with this argumentation.

- Job protection. Don’t forget that you are in control. Your arguments should be: we will get more time for deeper analyses, business control, projects etc. or run the Risk that your Manager comes with the idea. The initiative should rather come from you.

In control

The sponsorship of the CEO and/or CFO to be able to implement Fast Close are essential. The reporting process is a high risk process where a lot of money is involved, that is why it is in everyone’s interest that it is successful. A lack of sponsorship is a serious risk.In practice there is always one company in the group where the automation of the process has not been completed. Communication is equally important. This must be done very careful before, during and after the process. It is important that you share the results and mutual accomplishments with the employees in the organization on a regular basis.

Facts about Fast close

CFOKnowledge has performed a survey to acquire information about the status of the closing process. These are some of their published results:

- On the question whether organizations could speed up their reporting process most of the responding organizations said that they would be capable of speeding up the process by 40%.

- On the question “why is it important to close faster?” 44% responded that there is more time for in depth analysis, 31% said that a lot of money was released from the reporting process, and 25% was very pleased with faster information.

- Slow closing was in 40% of the respondents caused by the many review layers, 35% by the level of requested details in the consolidation and there was a lot of time lost by analysis and error corrections.

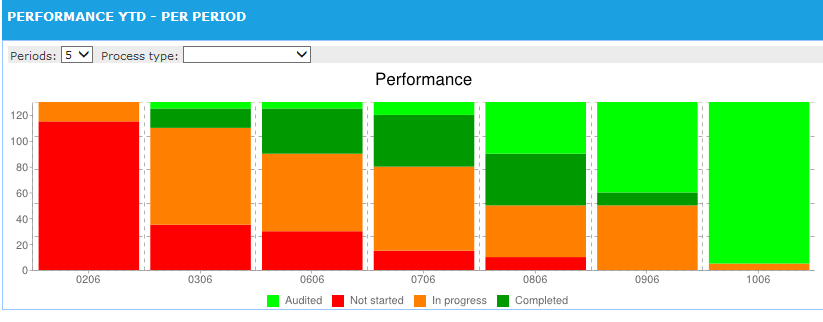

The secret of organizations that have reduced the number of reporting days and increased their (internal) customer satisfaction: 86% used an automated process. See this presentation. Also have a look at a tool called FastCloseManager

Conclusion

We hope that this post will motivate you to put Fast Close on the agenda for 2014, in case you can’t close in 5 days yet. If you are a controller or responsible for monthly and annual reporting and won’t put Fast Close on your agenda or consider to implement Fast Close, I would like to meet you!!

(1142)